IHMVCU is safe and financially strong. We're prepared for the unexpected and ready to handle the road ahead. Not only that, your deposits are federally insured by the National Credit Union Administration (NCUA), up to $250,000 per owner. The $250,000 in coverage applies to each share owner, per insured credit union, for each account ownership category.

For example, if you have a regular Savings account and an Individual Retirement Account (IRA) both at IHMVCU, the regular Savings account is insured up to $250,000 and the IRA is also insured up to $250,000. These are insured separately because each fall under different account ownership categories as explained below.

If you have a regular Savings account, a CD, and a checking account, all in your own name without any beneficiaries, these accounts all fall under an individual ownership category, are added together, and insured up to $250,000 as explained below.

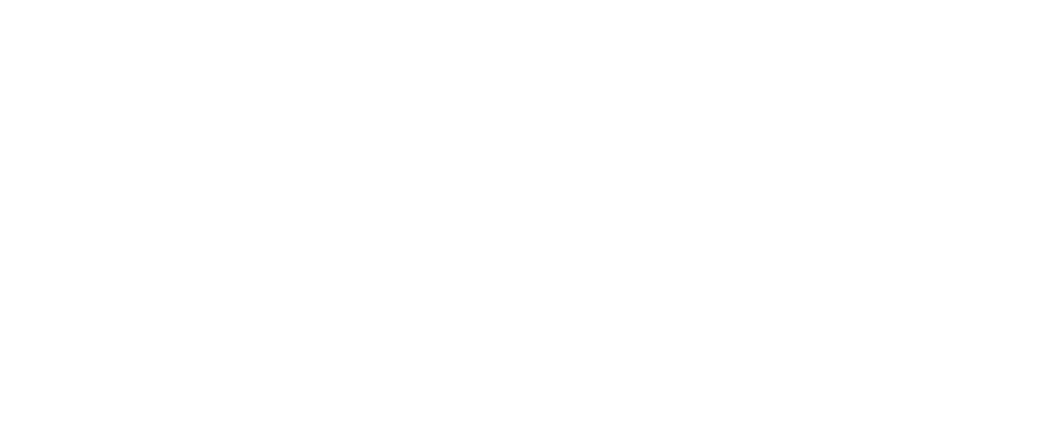

The most common ownership categories are shown in the chart below.

Note: Naming beneficiaries on a retirement account does not increase insurance coverage.

Note: Special rules apply for accounts with six or more beneficiaries.

POD = Payable on death

What's the NCUA?

Most of you are likely familiar with the FDIC, which insures the deposits of banks. Members of federally insured credit unions, like IHMVCU, also enjoy the same level of protection on their deposits as those provided by the FDIC through the National Credit Union Administration or NCUA.

The NCUA administers the National Credit Union Share Insurance Fund (NCUSIF). The NCUSIF, like the FDIC's Deposit Insurance Fund, is a federal deposit insurance fund backed by the full faith and credit of the U.S. Government.

FAQs:

I have more than $250,000 in a CD, do I need to remove some to be fully protected?

If you are the single owner of the CD, then your money is only protected up to the $250,000. If you want to be fully protected, give us a call to discuss options for better coverage.

Another bank I work with has protection up to $500,000, why is IHMVCU different?

Some institutions offer private deposit insurance as supplemental coverage for amounts exceeding federal limits. Because IHMVCU is safe and financially strong, we are confident in the standard coverage provided by the NCUA.

As a business owner, I'm concerned about NCUA coverage, what things can I do to stay protected?

Funds owned by Corporations, LLC’s, Partnerships and Unincorporated Associations (clubs, churches) are insured for up to $250,000 for all accounts owned by that business. The number of partners/owners that the business has does not affect coverage. This is separate from any personal accounts that the business account owners might have with IHMVCU. Sole Proprietorships are insured under the same umbrella as the owner’s personal individually owned accounts.

I'm concerned about a recession, what if business at IHMVCU goes south, how do I make sure I keep my money safe?

The NCUA protects members against losses should a federally-insured credit union fail. Not one penny of insured savings has ever been lost by a member of a federally-insured credit union. No credit union may terminate its federal insurance without first notifying its members. Rest assured, IHMVCU is safe and financially strong. We prepare for the unexpected and ready to handle the road ahead.

I have trust accounts at other financial institutions (FI), how do I make sure I'm protected at each one?

Accounts our members have at other institutions are insured separately. For example, you can have a revocable trust account here and at another FI, each is insurable up to NCUA or FDIC limits. If you have concerns about coverage amounts at other FI’s please consult directly with that institution.

Need more help?

The NCUA offers an electronic Share Insurance Estimator to generate a report of how your funds are insured or you can download the brochure.

Or give us a call to discuss other ways to structure your accounts to maximize your coverage.

Other questions? Chat with us!