Money Smarts Blog

Refresher course: Student loan payments

Sep 12, 2022 || Jim O'Leary, Financial Health Coach

Recently, President Joe Biden announced his plan to tackle federal student loan debt. You’re probably wondering what all of this means.

Here’s a quick breakdown:

- Up to $20,000 in debt cancellation to Pell Grant recipients with Department of Education loans

- Up to $10,000 in cancellation to non-Pell Grant recipients

- Extension of student loan deferral through Dec. 31, 2022; payments resume Jan. 2023

- Cancellation is for people earning less than $125K (and $250K for married couples)

- Borrowers will pay no more than 5% of their discretionary income monthly on undergraduate loans

- Raise the amount of income that's considered non-discretionary and therefore is protected from repayment

- Forgive loan balances after 10 years of payments, instead of 20 years

- Cover borrower's unpaid monthly interest

Details are still being hashed out. But if you have student loan debt and haven't been paying because of the forbearance, listen up. You've only got a short amount of time before those loans are going to come knocking at your door.

Since it's been almost three years without worrying about them, let's do a quick refresher course.

First, re-familiarize yourself with your loans.

Face it. You don't remember what you had for dinner last Wednesday, so it's not likely you'll remember where all your loans are located.

For those federal loans, you can just log into StudentAid.gov. That'll tell you who's holding your loans. If you have private loans, it could take a little more work to find your servicer(s). Start off by signing into your student loan accounts or checking your most recent student loan statement. Otherwise, all lenders should be listed on your credit report, which you can access for free through AnnualCreditReport.com.

The next thing to do is to make sure the loan holders have your correct communication information (i.e. email, mailing address, phone number). This is SUPER important because there's going to be some really important information that they'll be sending you that you're going to want to see.

Make sure you're on the best repayment plan for you.

A LOT changed during COVID, so chances are your repayment plan may need to, too.

How will making payments again fit into your monthly spending? Now would be a good time to review your budget so you know exactly what your expenses are and what you can afford to pay.

Consolidation—rolling several smaller loans into one big loan with the same servicer, could make it easier to manage your payments. But, be careful combining federal and private loans. Consolidating federal loans with a private lender means you forfeit the buyer protections, like income-based repayment, that comes with them.

Though consolidation will usually leave you with a smaller monthly payment, it might also extend your repayment period. So even if you have a lower interest rate after consolidation, you could end up paying more overall when you factor in the extra time.

If you have multiple loans with different due dates, interest rates and repayment terms refinancing with one loan to consolidate should make managing your payments easier.

Depending on your loan terms, refinancing even one loan at a better interest rate can save you quite a bit of money down the road, too.

But before you go gung ho and start signing documents, make sure you’re actually going to save money, not just switch lenders. There’s kind of a lot to consider – this infographic makes it a little easier to figure out what to pay attention to.

Be on the lookout for scams.

This is prime time for scammers, so here's some red flags to look out for:

- Red flag #1: Someone reaching out to you and they're asking you for your student loan account PIN or password. Not only would no legitimate student loan company ever ask you for that, it's now illegal for them to do that under the STOP Act.

- Red flag #2: Someone promises you forgiveness right out of the gate without really knowing anything about your situation.

If you feel you’ve fallen victim to a scam, report it to the Federal Trade Commission.

Enroll in automatic payments.

Enrolling in automatic payments allows your lender to receive payments without requiring you to log in or mail a check each month. Just make sure the correct funds are available in your account before your due date(s) so you aren’t charged overdraft fees.

You can still make one-time payments too. So it won’t prevent you from paying a little more when you find yourself with extra cash.

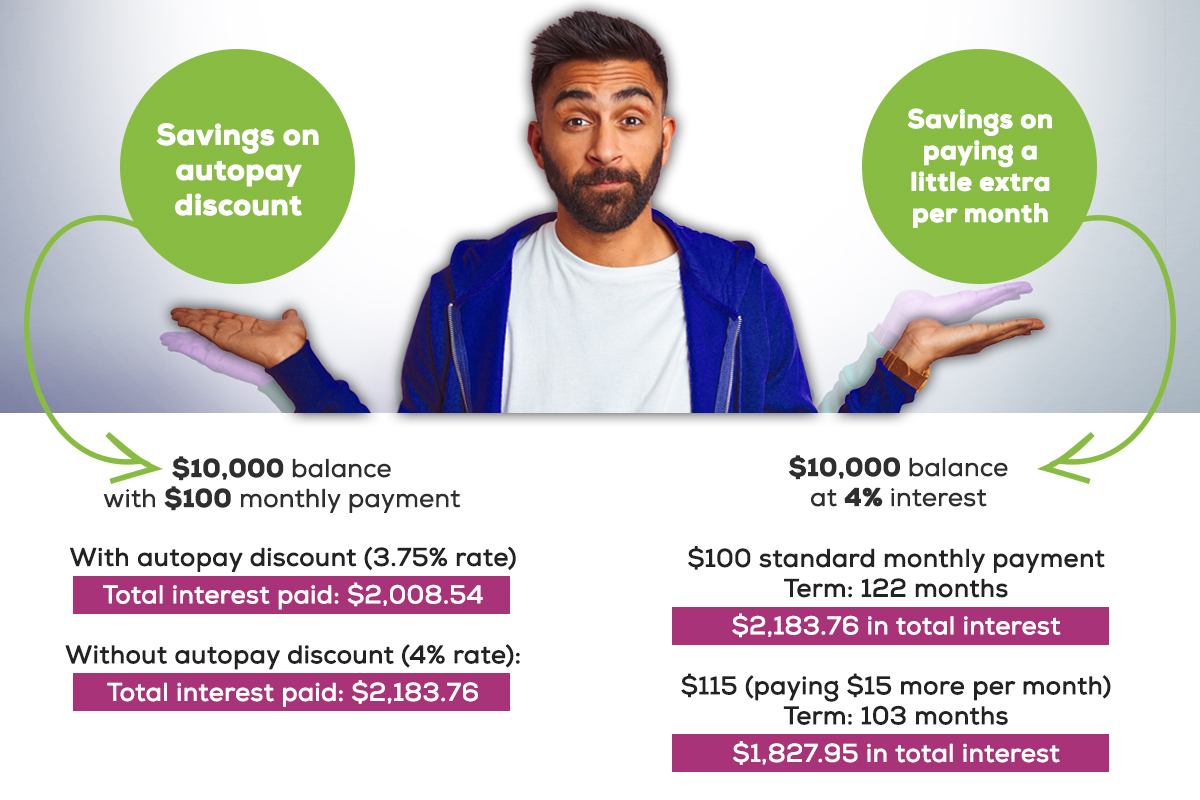

Even better than reducing some stress, some servicers will reduce your interest by a small amount as an incentive to enroll in automatic payments. Check with your lender to see if they offer an incentive—according to FinAid.org, the most common discount is a 0.25% interest rate reduction.

Everyone’s financial situation is a little different, but the key to paying off any debt is consistency. By making at least the minimum payment each month, you avoid late fees and penalties, putting you much further ahead than if you skip payments.

Pay more than the minimum - but not too much more.

Pay more than the minimum - but not too much more.

It may seem obvious, but making extra payments is the fastest way to pay off any loan.

Now we’re not saying you should funnel every extra penny into your student loans. That’s exactly how you end up in your parents’ basement with no life.

We ARE saying you should pay at least a little extra every month if at all possible. Remember the automatic payments we just talked about? If you set it and forget it, you won’t even know you had it in the first place!

Make sure you won’t be penalized for pre-payment, then figure out what works with your budget. Some lenders will automatically apply any extra monies to the next month’s payment, allowing you to essentially pay a month early. So make sure your lender knows you want anything extra to be applied to the principal and will continue to make monthly installments.

Adding even as little as $15 more every month reduces your principal, and the interest you pay on it the next month, faster than if you only pay the minimum. Start with $15 over the minimum payment and slowly increase your payments as you gain momentum.

If you’re unsure of how payments will fit into your budget or just need some help understanding it all, set up a time to chat with one of our Financial Health Coaches.