Money Smarts Blog

Your tax return could be affected by the Advance Child Tax Credit

Feb 2, 2022 || Sara Fossey and Courtney Kay-Decker

If you received monthly Child Tax Credit payments in 2021, you may be in for a surprise at tax time.

In this article we go over what the Child Tax Credit is, how your refund could be affected, when to expect Letter 6419 and additional resources.

First, what is the Advance Child Tax Credit?

The Child Tax Credit, or CTC, is an annual tax credit available to taxpayers with qualifying dependent children. Introduced as part of the Taxpayer Relief Act of 1997, it's played an important role in providing financial support for American taxpayers with children.

The tax credit — normally up to $2,000 per qualifying dependent (with an extra $600 for those under age 6) — was expanded last year as a part of the American Rescue Plan.

For 2021, the maximum Child Tax Credit was $3,000 per child 6 to 17 years old,* and $3,600* for children under age 6. And for the first time in history, up to half of the total per-child-amount was eligible to be paid in advance monthly installments. The first round of monthly Advance Child Tax Credit payments was sent to eligible families starting July 15, through December of 2021.

*Disclaimer: These advance payment amounts will be less if your adjusted gross income (AGI) exceeds $150,000 if married and filing a joint return or if filing as a qualifying widow or widower; $112,500 if filing as head of household; or $75,000 if you are a single filer or are married and filing a separate return.

Your refund may be less (or you may owe taxes)!

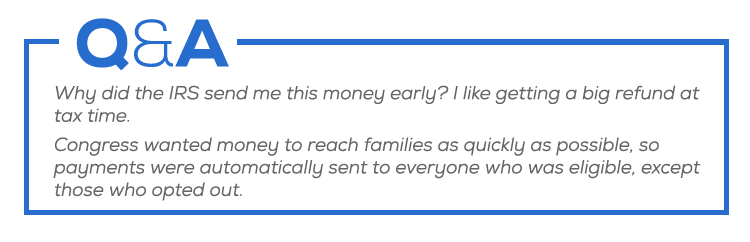

If you were eligible for the advance portion of the credit and did not opt-out, the IRS automatically sent the "advance" portion of the Child Tax Credit to you, estimated based upon information in the government's records from prior years.

The money came in monthly payments — up to $250 per month for children between the ages of 6 and 17 and up to $300 per month for those under the age of 6. It gets more complicated, though. The monthly payment was split between parents in many cases. To the extent possible, those amounts were direct deposited into the parents' accounts.

So if you didn't opt-out of receiving advance payments, your refund might look a little lower this year because you’ve already received some of those expected funds.

For example, if you qualified for a $3,000 tax credit and received payments of $1,500 in advance, you’ll subtract the $1,500 received from July through December from the total credit you’re entitled to claim, then report the excess amount of $1,500 as a Child Tax Credit on your 2021 return.

Even though the total Child Tax Credit is more this year, the amount that you have left to receive may be less than the total that you received last year (because remember, last year's payments were $2,000 per child aged 17 and under). If that's the case, then your tax return may be less than what you expected.

The IRS developed FAQs to help taxpayers understand how the credit works. For more details on the mechanics of the credit, consult the IRS website or your tax advisor.

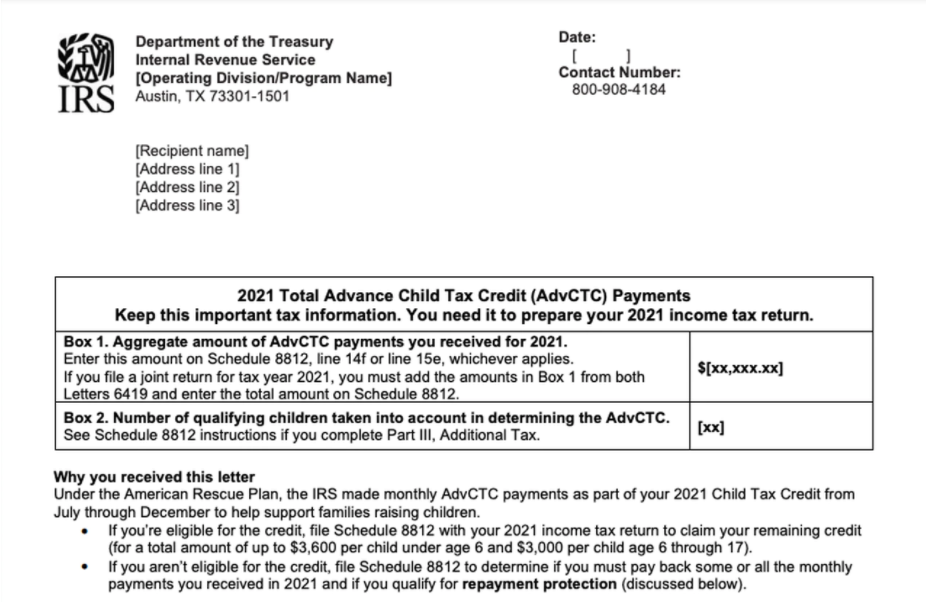

Watch for Letter 6419.

Families who received advance payments must file a 2021 tax return to compare the advance payments they received in 2021 with the amount of the Child Tax Credit they can properly claim on their 2021 tax return. The IRS is sending Letter 6419 to each parent who received advance payments in 2021 to help taxpayers reconcile and receive all the 2021 child tax credits to which they are entitled. The will tell you how much money you received in 2021 and the number of qualifying dependents used to calculate payments.

Remember: Each parent will receive a letter. The IRS expects to have mailed everyone's Letter 6419 by the end of January.

If the amount you report as Advance Child Tax Credit payments on your tax return doesn't match the amount on your (and your spouse's, if applicable) Letter 6419, your refund will be delayed. Electronically filing an accurate return is the quickest way to get your refund.

Eligible families who didn't receive any Advance Child Tax Credit payments can claim the child tax credit on their 2021 federal tax return. To receive the credit, you'll need to file a tax return. This applies even if you usually aren't required to file.

What if I didn't get a letter?

If you don’t receive the letter, you can find out how much you’ve received in Advance Child Tax Credit Payments using the portal at IRS.gov.

If you haven't already, you'll be asked to create an account. That requires proving that you are who you say you are – a necessary step to keep criminals out of your personal tax information. The authentication process works best with a smartphone.

This post is meant to provide general information and should not be relied upon as personal tax advice.

About the Authors:

Sara Fossey is the VITA Manager at United Way Quad Cities. Courtney Kay-Decker is a volunteer site coordinator for the Quad Cities VITA program and practices law at Lane & Waterman, LLP. Previously, she served as the Director of Revenue for the State of Iowa.